Blog

-

How to Use Home Equity to Fund Major Purchases: A Comprehensive Guide

Introduction Home equity is a powerful financial tool that can help you fund major purchases without relying on high-interest credit cards or personal loans. By leveraging the value of your home, you can access significant funds at relatively low interest rates. In this comprehensive guide, we’ll explore the various ways to use home equity, the […]

February 9, 2025 -

The Hidden Potential of Your Home: Unlocking Home Equity for Financial Freedom

Introduction Your home isn’t just a place to live; it’s also a powerful financial asset that can help you achieve your financial goals. Home equity, the difference between your home’s market value and the outstanding mortgage balance, can be a valuable resource when used wisely. In this article, we’ll explore the hidden potential of your […]

February 9, 2025 -

How Much Home Equity Do You Really Need to Access? Find Out Here

Introduction Home equity is a powerful financial tool that can provide you with access to significant funds for various purposes. But how much home equity do you really need to access? In this article, we’ll explore the factors that determine the amount of home equity you should tap into, the different methods of accessing home […]

February 9, 2025 -

The Pros and Cons of Using Home Equity for Debt Consolidation

Introduction Debt consolidation is a financial strategy that involves combining multiple debts into a single loan with a lower interest rate and more manageable monthly payments. One option for consolidating debt is to use the equity in your home. Home equity is the difference between the current market value of your home and the outstanding […]

February 9, 2025 -

How to Maximize Your Home Equity with Smart Financial Planning

Introduction Home equity is one of the most powerful financial assets you can build as a homeowner. By strategically managing your home equity, you can leverage it for various financial goals, from home improvements to retirement planning. In this article, we’ll explore how to maximize your home equity through smart financial planning. Understanding Home Equity […]

February 9, 2025 -

Home Equity 101: What Every Homeowner Needs to Know

Introduction As a homeowner, understanding the concept of home equity is crucial. Home equity is an important financial tool that can significantly impact your financial wellbeing. In this article, we’ll explore the ins and outs of home equity, how it’s calculated, and the various ways you can leverage it to your advantage. What is Home […]

February 9, 2025 -

Exploring the Benefits of Home Equity: Is it Right for You?

Introduction Home equity is one of the most valuable financial resources available to homeowners. It represents the portion of your property that you own outright and can be leveraged for various financial goals. In this comprehensive guide, we’ll explore the benefits of home equity, how to access it, and factors to consider to determine if […]

February 9, 2025 -

How to Tap Into Your Home Equity Without Risking Your Property

Introduction Home equity is a significant financial asset that can provide homeowners with the funds needed for major expenses. However, tapping into home equity comes with risks, particularly the possibility of losing your property if you fail to make payments. In this comprehensive guide, we’ll explore strategies for accessing your home equity safely, ensuring that […]

February 9, 2025 -

How to Leverage Home Equity for Debt Consolidation: A Simple Guide

Introduction Managing multiple debts can be overwhelming and financially draining. Leveraging home equity for debt consolidation is a smart strategy that can simplify your finances, reduce interest rates, and accelerate your journey to becoming debt-free. In this guide, we’ll explore how to use home equity for debt consolidation, the benefits and risks, and practical steps […]

February 9, 2025 -

Top Strategies for Increasing Your Home Equity in a Competitive Market

Introduction In a competitive real estate market, building home equity is crucial for financial stability and long-term investment growth. Home equity not only enhances your net worth but also provides you with valuable financial leverage. In this comprehensive guide, we’ll explore the top strategies for increasing your home equity, ensuring that you make the most […]

February 9, 2025 -

How Home Equity Can Help You Fund Major Life Expenses

Introduction Home equity is a significant financial asset that homeowners can leverage to fund various major life expenses. Understanding how to utilize this resource wisely can provide you with the financial flexibility and stability needed to manage significant costs. In this comprehensive guide, we’ll explore how home equity works, ways to access it, and smart […]

February 9, 2025 -

Is Borrowing Against Your Home Equity a Good Idea? Pros and Cons Explained

Introduction Home equity is a valuable asset that can be leveraged for various financial needs. Borrowing against your home equity can provide access to funds for major expenses, but it’s important to weigh the pros and cons before making a decision. In this comprehensive guide, we’ll explore the benefits and drawbacks of borrowing against your […]

February 9, 2025 -

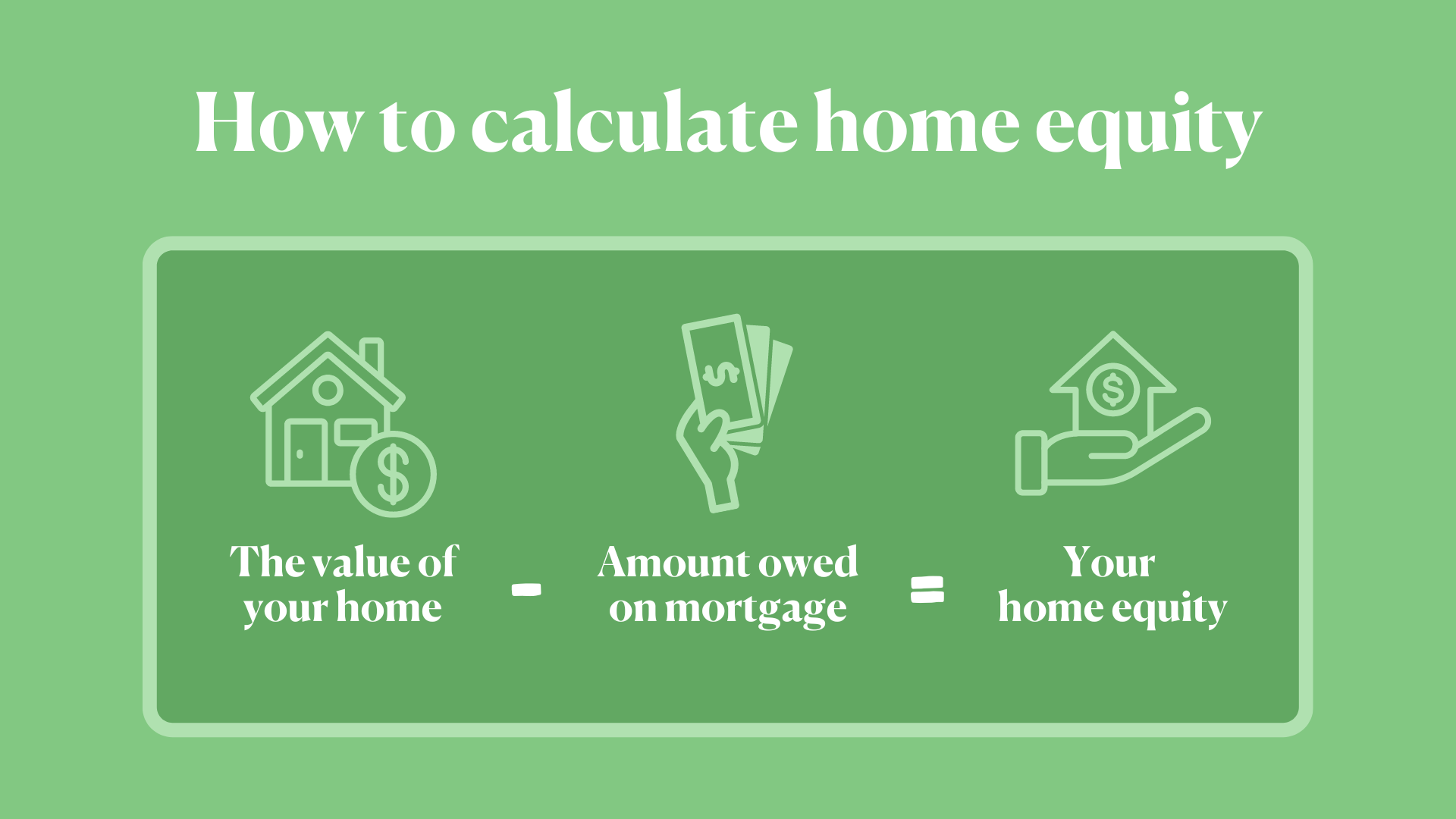

How to Calculate Your Home Equity: A Step-by-Step Guide

Introduction Understanding your home equity is essential for making informed financial decisions. Home equity represents the portion of your property that you truly own, and it can be a valuable asset for funding various expenses, from home improvements to debt consolidation. In this comprehensive guide, we’ll walk you through the process of calculating your home […]

February 9, 2025 -

5 Smart Ways to Use Home Equity for Home Improvements

Introduction Home equity is a valuable asset that homeowners can leverage to make meaningful improvements to their property. By tapping into your home’s equity, you can fund renovations that not only enhance your living space but also increase the overall value of your home. In this guide, we’ll explore five smart ways to use home […]

February 9, 2025 -

The Ultimate Guide to Unlocking Your Home Equity for Financial Growth

Introduction Home equity is one of the most valuable assets that homeowners can leverage for financial growth. By understanding how to unlock and use home equity responsibly, you can achieve various financial goals, from renovating your home to funding important life events. In this comprehensive guide, we’ll explore the concept of home equity, how to […]

February 9, 2025