Home Equity

-

How Much Home Equity Do You Really Need to Access? Find Out Here

Introduction Home equity is a powerful financial tool that can provide you with access to significant funds for various purposes. But how much home equity do you really need to access? In this article, we’ll explore the factors that determine the amount of home equity you should tap into, the different methods of accessing home […]

February 9, 2025 -

How to Tap Into Your Home Equity Without Risking Your Property

Introduction Home equity is a significant financial asset that can provide homeowners with the funds needed for major expenses. However, tapping into home equity comes with risks, particularly the possibility of losing your property if you fail to make payments. In this comprehensive guide, we’ll explore strategies for accessing your home equity safely, ensuring that […]

February 9, 2025 -

Do You Lose Home Equity When You Refinance?

Refinancing your mortgage can be a strategic move to secure better loan terms, reduce monthly payments, or access home equity. However, it’s natural to wonder whether refinancing might impact the equity you’ve built in your home. This comprehensive guide will provide accurate information, practical tips, and a clear understanding of how refinancing affects home equity, […]

February 6, 2025 -

Home equity loan vs. mortgage: How are they different?

Navigating the world of home financing can be complex, especially when faced with terms like home equity loans and mortgages. While both options allow you to leverage the value of your home, they serve different purposes and come with distinct features. Understanding these differences is crucial for making an informed decision that aligns with your […]

February 7, 2025 -

5 Smart Ways to Use Home Equity for Home Improvements

Introduction Home equity is a valuable asset that homeowners can leverage to make meaningful improvements to their property. By tapping into your home’s equity, you can fund renovations that not only enhance your living space but also increase the overall value of your home. In this guide, we’ll explore five smart ways to use home […]

February 9, 2025 -

Are student loans considered as debt when getting a HELOC?

Understanding Home Equity Lines of Credit (HELOC) Home Equity Lines of Credit (HELOCs) are a popular financing option for homeowners who want to leverage the equity in their homes. HELOCs provide a flexible line of credit that can be used for various purposes, such as home improvements, debt consolidation, or other major expenses. However, when […]

February 7, 2025 -

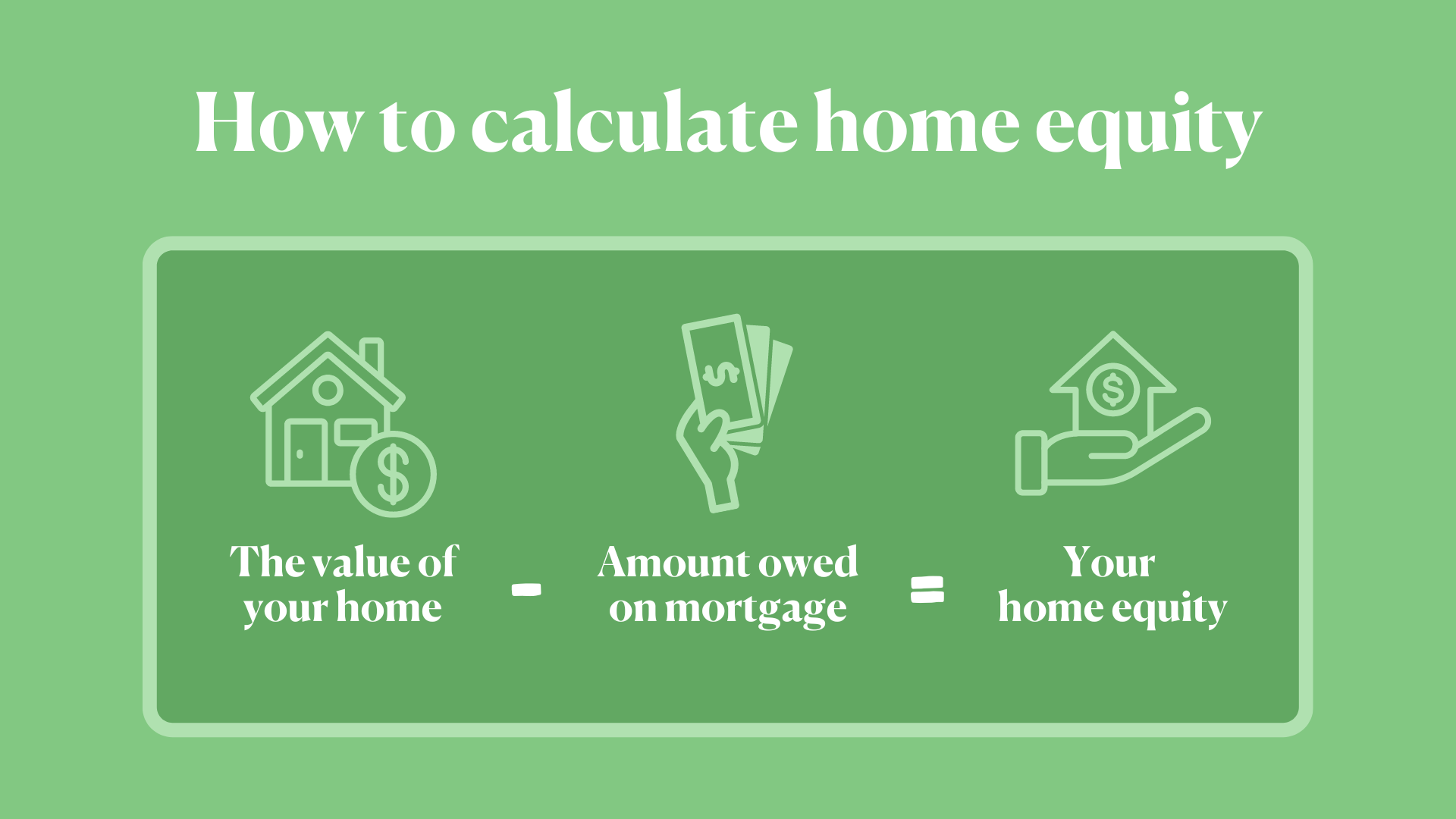

How to Calculate Your Home Equity: A Step-by-Step Guide

Introduction Understanding your home equity is essential for making informed financial decisions. Home equity represents the portion of your property that you truly own, and it can be a valuable asset for funding various expenses, from home improvements to debt consolidation. In this comprehensive guide, we’ll walk you through the process of calculating your home […]

February 9, 2025 -

Can my house be used as collateral for multiple loans?

Using your house as collateral for a loan can be a powerful financial strategy, providing access to significant funds for various purposes. But what happens if you need to secure multiple loans? Can your house be used as collateral more than once? This article explores the feasibility and implications of using your house as collateral […]

February 7, 2025 -

Exploring the Benefits of Home Equity: Is it Right for You?

Introduction Home equity is one of the most valuable financial resources available to homeowners. It represents the portion of your property that you own outright and can be leveraged for various financial goals. In this comprehensive guide, we’ll explore the benefits of home equity, how to access it, and factors to consider to determine if […]

February 9, 2025 -

The Pros and Cons of Using Home Equity for Debt Consolidation

Introduction Debt consolidation is a financial strategy that involves combining multiple debts into a single loan with a lower interest rate and more manageable monthly payments. One option for consolidating debt is to use the equity in your home. Home equity is the difference between the current market value of your home and the outstanding […]

February 9, 2025